§1031 Exchange Guide for Real Estate Investors

Some of the most successful real estate investors in the country use §1031 exchanges, also called Starker exchanges or like-kind exchanges, as a tax deferral strategy. 2022 is an excellent time to exchange properties because prices have surged past the so-called real estate bubble prices of the past decade.

This means that with a successful §1031 exchange, you can essentially trade property in an expensive market for one or multiple properties in other up-and-coming areas of the country, without incurring federal income taxes at the time of the swap.

So, in this article, we will provide a comprehensive guide to §1031 exchanges, including what they are, how they work, the various types and rules that apply, when to do an exchange, and which states have the best §1031 exchange markets currently. At any time you have a question or want to get started, you either call us or request a specialist to call you.

What is a §1031 Exchange?

Section 1031 of the Internal Revenue Code (To IRS.gov) details how a §1031 exchange works. Essentially, it allows an investor to defer the payment of federal income taxes typically incurred by selling an investment property, so long as the profit from the property sale is used to purchase a ‘like-kind’ property. The words “like-kind” refer to the nature or character of the property and not to its grade or quality.

This type of exchange provides benefits beyond the obvious financial benefit of tax deferral – it allows you to relocate your investment from properties in one part of the country to another area without trouble from the IRS, and you can switch from high-maintenance to low-maintenance investment properties without a massive tax hit.

Benefits of a 1031 Exchange

There are several benefits of a 1031 exchange. The biggest one is the deferment of capital gains taxes on the sale of an investment property. This allows an investor to make a bigger down payment on a more valuable property than would have been possible otherwise, which is an excellent way to grow wealth and build an investment portfolio.

1031 exchanges also allow investors to move their investments around easily and diversify their portfolios to minimize risk. They can also be used to move from investment properties that require a lot of hands-on management (like short-term rentals or apartment complexes) to properties that require less direct management.

They can also be used for estate planning purposes. Normally, 1031 exchanges are only a tax deferral strategy rather than tax avoidance, but if an investor purchases a property through a 1031 exchange and then dies, leaving the property to an heir, the deferred taxes will be essentially erased. The heir will receive the property at a stepped-up market value rate and will not have to pay the deferred tax amount. An estate planner can provide the exact details on how to take advantage of this strategy.

Changes to Section 1031 Rules

Originally, investors were able to use 1031 exchanges to swap personal and intangible property as well as real estate. So, items like vehicles, machinery and other equipment, artwork, and other collectibles, and patents, and other intellectual property could be exchanged. However, under the Tax Cuts and Jobs Act, the scope of 1031 exchanges was reduced to real estate only as of January 1, 2018.

How Does a 1031 Exchange Work?

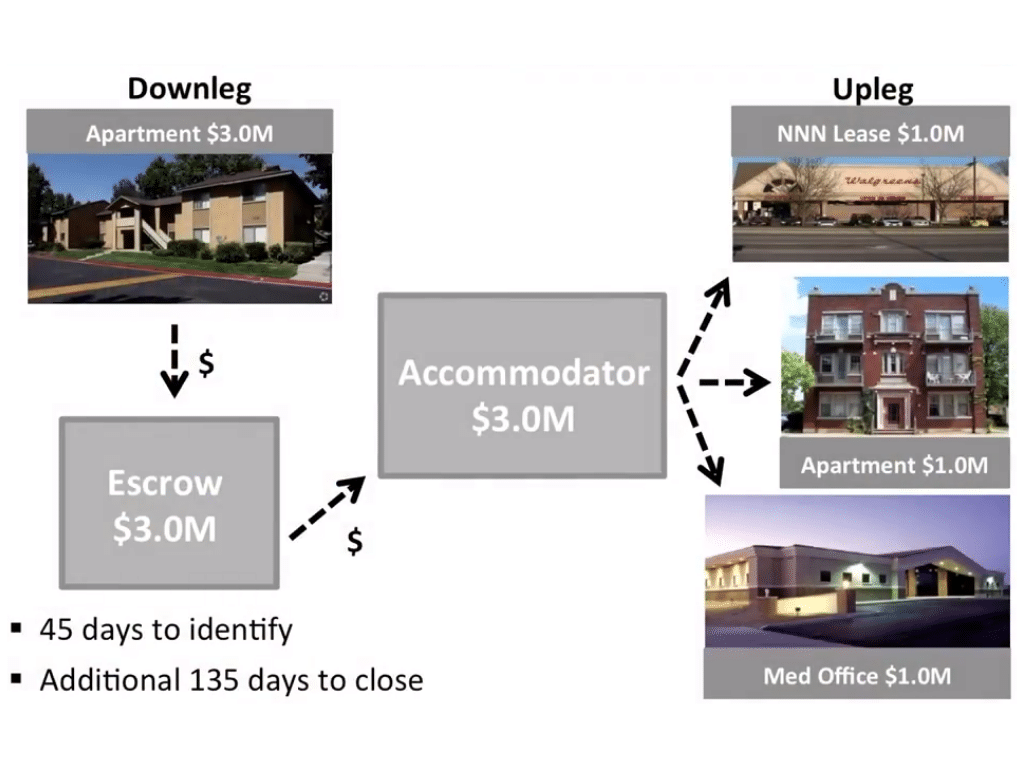

The 1031 exchange process includes the escrow, the accommodator and the 45 day period.

First of all, you have a property that you’re selling and this, we call the downleg. When the downleg sells the funds are going to go into an escrow. An escrow is a neutral third party, whose job it is, is to make sure that both parties execute on the contract of sale of your property. This is important to understand because when your property sells and the funds are released, they cannot go into your name or your bank account if they do they’re now taxable. To get around this, you are required to have another neutral third party known as the accommodator. The accommodator’s job is to hold the funds in their name, not your name while you do your 1031 exchange.

Now that your funds have transferred to the accommodator, the IRS gives you 45 days to identify or pick the properties that you want to purchase. In this case, the case study below shows 1 downleg properties and the 3 properties you’re transferring into, or the upleg.

Once you’ve identified the upleg, and you’ve recorded that with the accommodator, you now have an additional 135 days to actually close escrow and take possession of those properties. The 45 day period, plus the additional 135 days gives you a total of 180 days from the beginning of this process to the end. At the end of that, you must have those new properties transferred in your name.

It’s very important to understand these rules. You cannot take those funds into your name in any way, shape or form, or you get taxed. You cannot go past the 45 day period while you identify the property or you get taxed and you can’t go past the 180 day total period in order to take possession of the properties, or again, you get taxed.

Video: 1031 exchange process explained by Rusty Tweed

4 Types of 1031 Exchanges

In order to fully demonstrate how §1031 exchanges work, we need to look at the four main types of 1031 exchanges and the usefulness of each one.

Delayed §1031 Exchange

Delayed §1031 exchanges are perhaps the most popular because they provide an extended timeframe in which the exchange can be completed. With this type of exchange, the property investor first arranges the sale of their original property and then buys the replacement property afterward.

The investor must market the initial property, secure a buyer, negotiate a purchase agreement, and execute a sale, all before even initiating the delayed exchange. Once those steps have been completed, the investor is then responsible for hiring a third party qualified intermediary. The qualified intermediary then holds the proceeds of the sale for up to 180 days in a binding trust, while the investor finds and acquires a like-kind property to complete the exchange.

With this type of exchange, the investor has up to 45 days to choose a replacement property and 180 days to complete the entire exchange. The time frame in which a delayed §1031 exchange is very strict and must be adhered to or it could disqualify the exchange from favorable tax treatment. This takes some pressure off the deal and allows the investor to sell while the market is in their favor and then take some time to select the best possible replacement property or properties.

A qualified intermediary (QI) must be used to handle the transaction. They will accept the proceeds from the sale of the relinquished property, hold them in trust, and then transfer them to the seller of the replacement property at the appropriate time. In this way, the money never actually enters the investor’s bank accounts and allows them to defer the capital gains taxes. A QI can be a person or a company, but they can have no formal relationship with either of the parties engaged in the exchange. QIs must also meet certain insurance requirements to perform this role.

Reverse §1031 Exchange

A reverse exchange or forward exchange happens in the exact opposite order from a delayed exchange. With this type of exchange, the investor buys a replacement property first through an exchange accommodation titleholder and sells his or her original (or relinquished) property afterwards.

While theoretically simple, reverse exchanges can be a bit trickier to execute. The investor is required to use all cash for the purchase, and many banks do not offer loans for reverse exchanges. If the investor does not close on the relinquished property within 180 days of purchasing the replacement property, the exchange will not qualify and federal income taxes could be due on the sale.

Simultaneous §1031 Exchange

A simultaneous §1031 exchange requires that both the relinquished and replacement property close at the same day and time. Even a slight delay caused by the money transfer process or some other hindrance can disqualify the exchange and result in the federal income taxes potentially being owed on the disqualified exchange.

There are three different ways to go about a simultaneous exchange. First and most simply, there can be a two-party swap of deeds between the owners of the two properties. Next, there can be a three-party exchange that is facilitated by an accommodating party. Finally, there can be a simultaneous exchange through a qualified intermediary.

Construction or Improvement §1031 Exchange

This type of exchange allows an investor to make improvements on the replacement property using the equity from the sale of the relinquished property, while a qualified intermediary holds the deed of the property in trust for up to 180 days. Three requirements must be met for this type of exchange:

- the entire equity amount must be spent as down payments for improvements or on completed construction or improvements by the 180th day from the initiation of the exchange.

- You must receive “substantially the same property” as what you identified on the 45th day as your replacement property, and

- The replacement property must be of equal or greater value when the investor receives the deed back from the intermediary after 180 days. The improvements must already be in place before you can receive the deed from the qualified intermediary.

1031 Exchange Rules & Requirements

There are 5 primary §1031 exchange rules and requirements that must be met for a successful tax deferral. Let’s look at what each rule entails:

The relinquished and acquired properties must be like-kind properties, which means that they must be similar in nature or character, although they can differ in quality or grade. As it applies to real estate, almost any type of property can be exchanged with nearly any other type.

For instance, as long as both or all properties involved are located within the United States, apartment buildings, duplexes, single-family rental property, commercial office building the rental property, vacation homes (rentals), and restaurant space rental properties can all be exchanged with each other since they are all essentially the same asset. This also means that you can exchange one large property for several smaller ones and vice versa. Please be advised that there are certain rules that apply for exchanges of one property for multiple replacement properties.

Rule #2: Investment or Business Properties Only

§1031 exchanges can only involve investment or business properties Personal properties such as a primary residence do not qualify. Also, personal property in general no longer qualified for tax deferral under §1031 due to the Tax Cuts and Jobs Act of 2017 (to TaxFoundation.com)

Rule #3: Greater or Equal Value Property Only

To have 100% of the federal income taxes deferred in exchange, the replacement property needs to have a net market value and equity that’s equal to or greater than that of the relinquished property.

So for instance, if your property is worth $1,000,000, you would need to select a replacement property that is worth at least that much, or a combination of properties whose total value equals or exceeds $1,000,000. You can choose to have more than one replacement property as part of your §1031 exchange, so long as their values add up to no more than 200% of the value of the relinquished property value. This is known as the ‘200% rule’ within the meaning of Treas. Reg. §1.1031 (to Cornell.edu).

It should also be noted that the replacement properties’ values will have no effect on the qualification of tax-deferred treatment under §1031 if no more than three like-kind properties are identified as replacement property. This is known as the “three property rule.” Acquisition costs such as inspector and broker fees can also be factored into the total cost of the new property or properties.

...Or You’ll Pay Taxes on the “Boot”

You can choose to do a partial §1031 exchange, where the property you relinquish is worth more than the replacement property, but you will have to pay federal income taxes on the difference, which is also called the “boot.”

For example, if you sell a property for $1,500,000 and want to exchange it for a property that’s worth $1,000,000, you would pay the standard amount of applicable federal (and state) income taxes on the $500,000 difference. In this situation, the ‘boot’ would be subject to capital gain rates.

The capital gains tax rate depends on your income tax bracket,as well as how long you held the investment property, and can be 0%, 15%, or 20%. The tax bracket requirements change each year to adjust for inflation, but for married couples who make more than $80,000 but less than about $500,000 per year, the capital gains rate will most likely be 15%.

Rule #4: Same Taxpayer Name

The name on the tax return and the title of the relinquished property must match the name on the purchasing documents for the replacement property. The only exception to this rule is if you use a single-member limited liability company (SMLLC) (To IRS.gov) to sell the relinquished property and your individual name to purchase the replacement property. SMLLC is disregarded for federal income tax purposes.

Rule #5: 1031 Exchange Time Limits

The name on the tax return and the title of the relinquished property must match the name on the purchasing documents for the replacement property. The only exception to this rule is if you use a single-member limited liability company (SMLLC) (To IRS.gov) to sell the relinquished property and your individual name to purchase the replacement property. SMLLC is disregarded for federal income tax purposes.

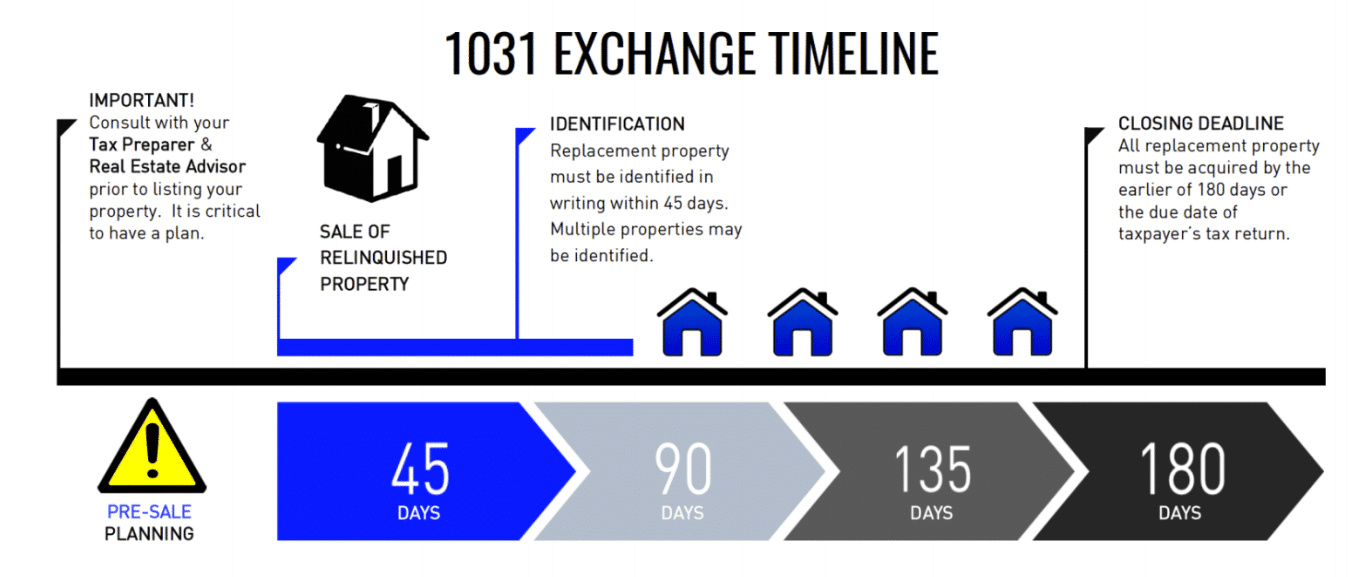

45-Day Identification Window

Once you close the sale of your relinquished property, you have 45 days to identify three potential like-kind properties for replacement.

180-Day Purchase Window

Once you’ve sold your relinquished property, you have 180 days to close on the purchase of the replacement property. This is not in addition to the 45-day window period – both periods elapse from the date of sale of the relinquished property, so you have 135 days after the 45-day identification window to complete the purchase of a replacement property. There is one exception to this rule which has to do with the due date of your federal income tax return.

There are a few other things to keep in mind when considering a §1031 exchange beyond these seven rules. For instance, do not plan to take this process on yourself – you need to hire a qualified intermediary to ensure the process is completed properly. Also, although the exchange fees vary state to state, you can expect to pay somewhere between $800 and $1,200 for a standard exchange.

§1031 Exchange Timeline

In its entirety, a §1031 exchange can take no longer than 180 days, or about six months. As we’ve mentioned above, once you initiate a §1031 exchange, you have 45 days to identify potential replacement properties, and then 135 days after that to complete the purchase of one or more of those properties.

When To Do a §1031 Exchange?

The best time to do a 1031 exchange is when you are in a high tax bracket that would require you to pay a high percentage of federal income taxes, but you want to keep cash on hand in order to keep reinvesting and expanding your real estate portfolio. By deferring the federal income taxes on new properties, you aren’t giving an extra-large portion of your investment capital to the government each year.

There is no limit on the number of §1031 exchanges you can do, so you can keep investing and swapping properties for as long as you like, and then only pay taxes once when you sell your properties for cash. It is also important to consider the attractive nature of §1031 exchanges for estate planning.

Video: Using a 1031 Exchange to Diversify and Increase Cashflow

When Not To Do a §1031 Exchange?

If you are in a very low tax bracket one year, you may want to hold off on a §1031 exchange and just pay the taxes that year at a lower rate than you would later if you know you’re going to be making more money in the future.

Additionally, if you have a loss on the year, there would be no gainon which to pay taxes, so it wouldn’t make sense to do a §1031 exchange in that instance either. Capital losses are limited to $3,000 per year for single individuals. Or, if you are in a low enough income tax bracket that you fall into the 0% capital gains tax bracket, you also wouldn’t pay anything and exchange would serve no purpose.

Lastly, if you want to invest in something that is not real estate, you may want to pay the taxes in order to have the cash in hand to invest in something else.

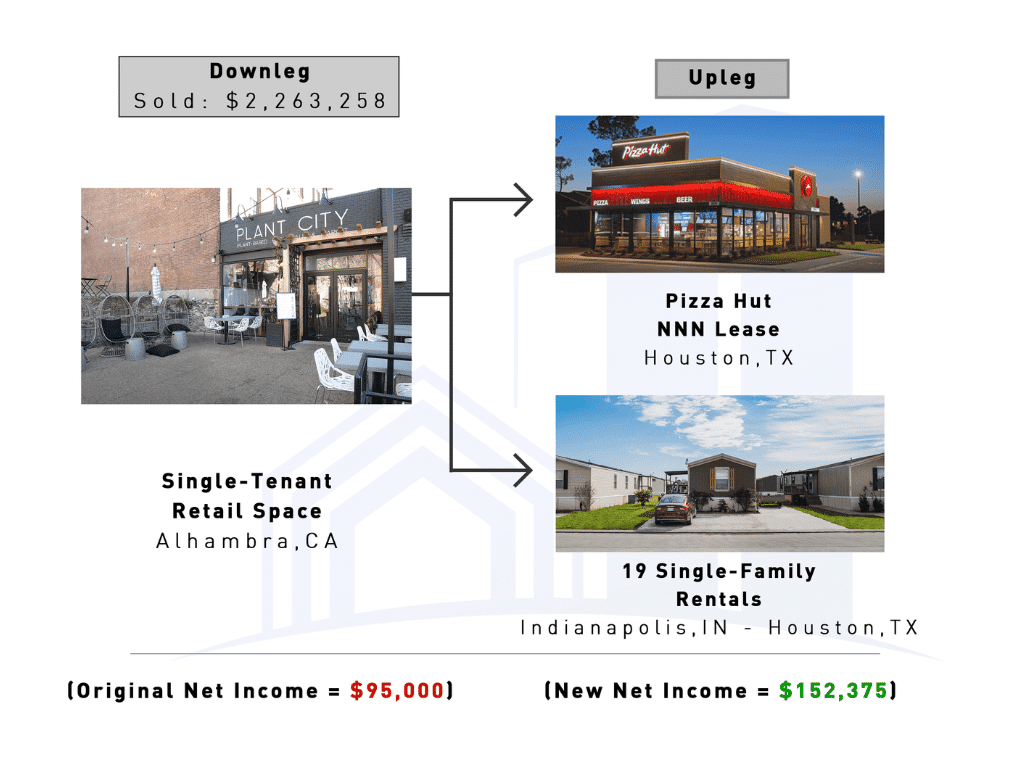

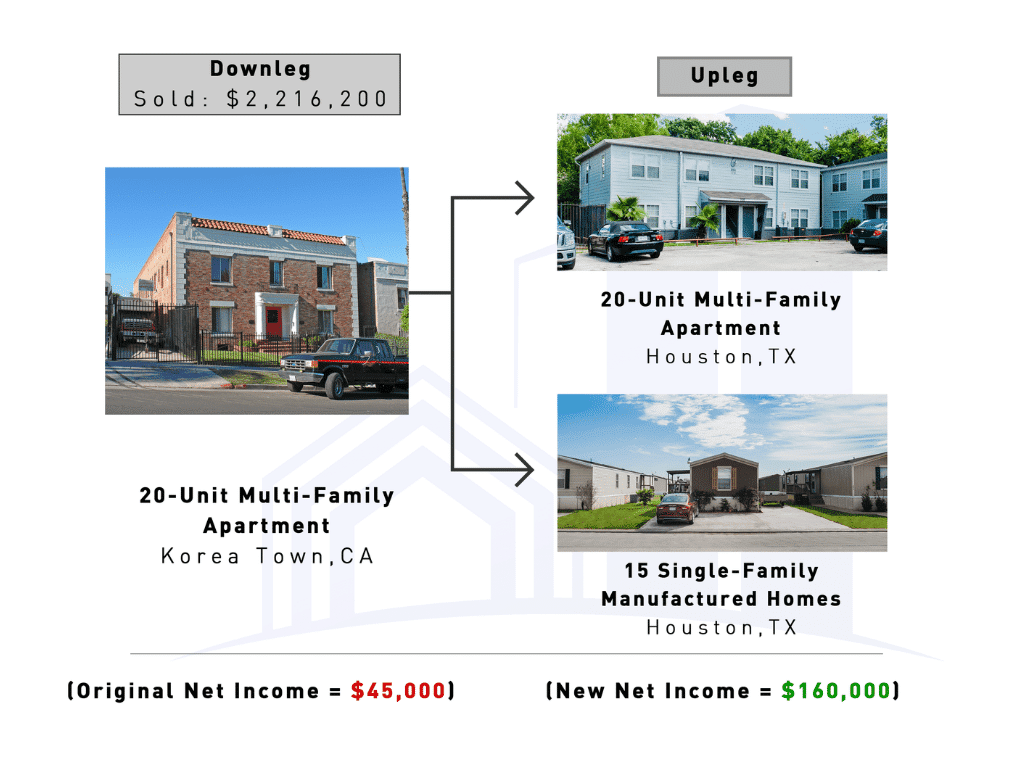

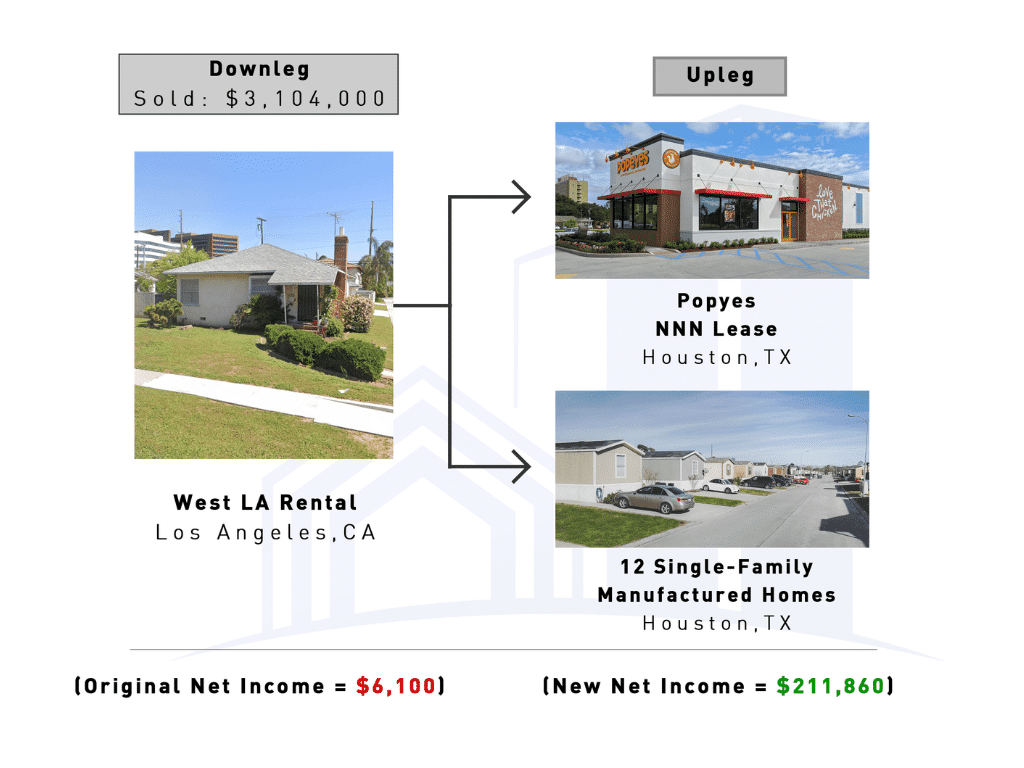

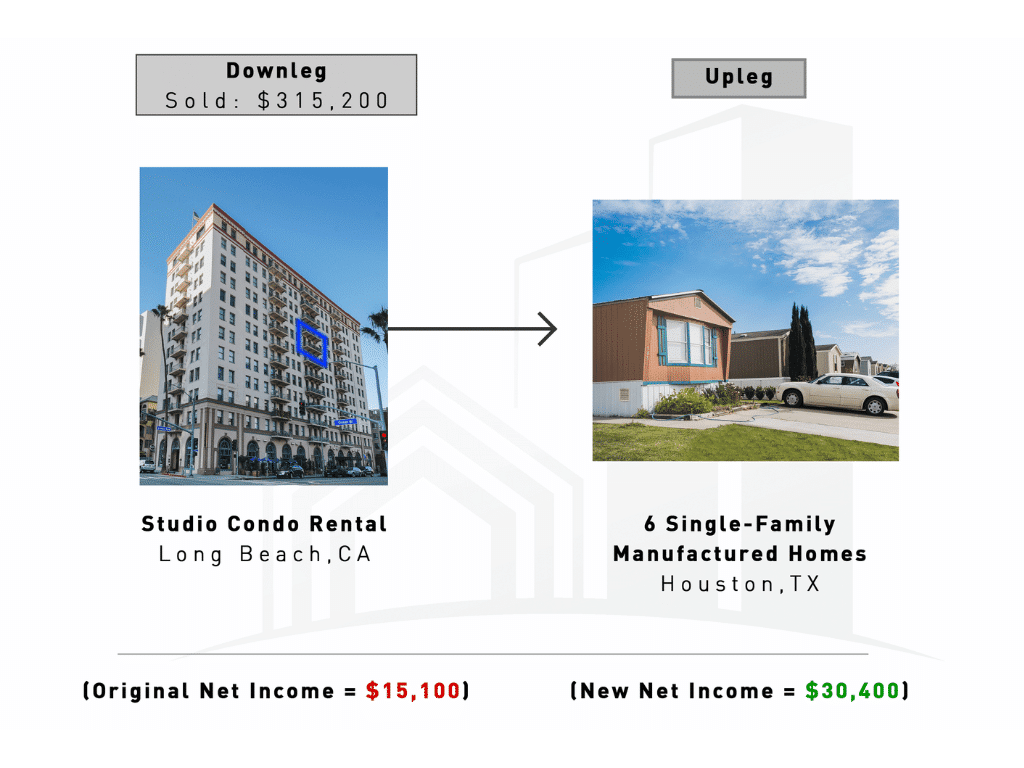

§1031 Exchange Case Studies

The overall goal when investing in real estate should be to exchange high-value investment properties for cash flowing turn-key investment properties in the strongest markets around the United States. A §1031 exchange is the perfect vehicle to achieve this goal.

Using 1031 Exchanges for Estate Planning

The 1031 Exchange is a real estate strategy used by sophisticated investors for deferring capital gains and also for estate planning purposes. Heirs of real property are positioned receive a full step-up in basis, which is an extremely powerful and advantageous tool for real estate investors – especially if they have performed multiple exchanges and traded up into larger, quality assets.

Keep Exchanging & Plan for a Full Step-Up in Basis for Your Heirs

When considering a 1031 Exchange, an investor is looking to “defer” their capital gains on their sale of investment property. More often than not, experienced real estate investors have built equity on their property through proper management & appreciation.

However, when it comes time for the sale of their property, many investors are unaware of the rate of their gain is actually being taxed! While we always advise that our clients consult with their CPA, our experience in the field allows us to estimate what this amount would ultimately be. This particularly applies to owners of rental property that they have fully depreciated and held on for many decades.

The 1031 Exchange is the perfect vehicle to defer the gain in its entirety while simultaneously planning for their estate. Once the properties are inherited, heirs receive a full step-up in basis based on the fair market value of the property at the time the property is passed on. As a result, the heirs are able to depreciate the property as if they had purchased the property that same day. This creates an increased depreciation deduction based on the straight-line depreciation of future market value.

Real World Example

One of our clients purchased a multi-family property in the early 1990s for $500,000. The client had been depreciating the property each year based on the initial acquisition price. Assuming the land value was $100,000 and the building value was $500,000: the client is able to deduct approximately $10,250 per year on their Schedule E ($400,000 / 39 Years).

As the years progressed, the client had exchanged “up” into larger, higher-quality properties. While utilizing the 1031 Exchange as a tool to defer their gains at each selling point so that they would not be taxed on their net profits, the client was also able to build their portfolio to approx. $5,000,000 in rental property based on current market value. Sadly, the client passed away last year.

While the client had been taking advantage of depreciation, their original tax basis had been reduced to just a few more years until there was none left to be depreciated. The moment he passed, following the instructions provided by his Living Trust, his heirs were able to inherit his portfolio & receive a full step-up in basis.

Meaning: Using straight-line depreciation on commercial property (39 years), the heirs were able to depreciate their properties based on the full $5,000,000 valuation. Assuming land value was $500,000, this means that the client was able to deduct $115,380 per year ($4,500,000 / 39) – a significant increase from what was being deducted when this portfolio began in the ’90s!

While each investor experiences a variety of different situations for their portfolio, we hope this illustration provides crucial knowledge on how to maximize 1031 Exchanges.

Does a Second Home Qualify for a 1031 Exchange?

As with most tax-related questions, the answer is “it depends”. Generally, for real property to qualify as relinquished property in a section 1031 exchange, the property must be held primarily for investment purposes and not for personal use. Luckily, the Internal Revenue Service (“IRS”) gave us Revenue Procedure 2008-16, which provides two separate safe harbors to assist taxpayers in making this determination. It is quite straight-forward and difficult to ‘side-step’.

What is Safe Harbor?

The safe harbor provided in Rev. Proc. 2008-16 states that in order for a vacation home or second home to qualify for tax deferral under section 1031, the exchanger is required to have owned the property for twenty-four months prior to the exchange. Also, within each of those two, separate 12-month periods, the exchanger:

What is Personal Use?

Personal use is defined by the Internal Revenue Code as any use by the property owners’ friends or family that do not pay rent at fair market value. However, if you have a family friend or family member staying in the property, paying fair market rent, AND it is their primary residence, the property would still qualify for a section 1031 exchange if all of the above safe harbors are also met.

Does a Ground Lease Qualify for a 1031 Exchange?

The short answer is “yes” but there are specific rules. The first step is to explicitly define what does and does not qualify for a section 1031 exchange. Prior to the Tax Cuts and Jobs Act of 2017, there was very ‘loose’ language in the Internal Revenue Code and accompanying regulations as to what actually qualified for a tax-deferred exchange under section 1031. Many business owners and individuals alike would utilize the advantages of section 1031 for vehicles and other personal property.

However, after former President Trump signed the Tax Cuts and Jobs Act into existence, one thing became abundantly clear, in order to qualify as a like-kind exchange under section 1031 the underlying property must be real property and held for investment use. There are very few exceptions.

What is a Ground Lease?

In general, a ground lease is a type of commercial lease where the tenant owns the building or structure but not the actual land the building or structure sits on. The landlord owns the land that the structure sits on and the tenant has rights to develop and use the building or structure for the duration of the lease and pays rent to the landlord for use of the land.

In most well-populated cities, the land that many structures and buildings sit on is owned by someone else rather than the name on the side of the building. Ground leases are very popular and are often structured as ‘net’ leases where the tenant pays all maintenance, property taxes, insurance, etc. on the building.

What are the rules?

IRS regulations state that a leasehold interest of 30 years or more would be like-kind to real property and thus qualify for section 1031 exchange. This 30 years is inclusive of extensions available to the tenant. For example, if you have a leasehold interest with an initial term of 25 years but the original lease calls for an extension of 10 years at the tenant’s request, the total leasehold interest is 35 years for purposes of section 1031.

Can I Buy a Business with a 1031 Exchange?

Yes. however, with most questions that involve any type of income tax, the answer is it depends. Since the Tax Cuts and Jobs Act of 2017 signed into law by former President Trump, the code only allows tax deferral for ‘real’ property held for investment or business use in a section 1031 exchange.

When you think about a business, generally, you think of inventory, equipment, office furniture, etc. If a certain aspect of the section 1031 exchange involves real property exchanged for real property, that portion of the exchange could qualify for tax deferral treatment. Any property that does not fall under the category of ‘real’ property will most likely be considered taxable ‘boot’ in the exchange.

How Do I Know How Much Tax I Pay?

The gain recognition rules in a section 1031 exchange are tricky and we certainly recommend you consult a tax advisor to assist you. Generally, when dealing with gains and losses for business purposes in federal income tax, there is a concept of basis which drives the gain or loss recognized on certain section 1031 exchanges.

What is Basis?

In the simplest of terms, ‘basis’ is what drives taxable gains and losses for federal income tax purposes. Calculating basis in a section 1031 exchange is a bit beyond the scope of this article, just keep in mind that basis drives the taxability of each sale for federal income tax purposes.

This is a complex area of federal income tax especially when you get into separating out personal property and real property for the section 1031 exchange. It can be a complex exercise that should be performed by someone with experience in the area. The answer to ‘Can I Buy a Business with a 1031 Exchange’ is ‘yes’ but a portion of the exchange may be taxable depending on the circumstances.

Reporting a 1031 Exchange to the IRS

Every 1031 exchange must be reported to the IRS on Form 8824. This must be completed by the investor and filed with their tax return for the year in which the exchange was completed. The form will ask for descriptions of both/all the properties exchanged, the dates of the sales of all properties, cash received or paid liabilities that were relieved or assumed, and the valuation of any like-kind and other property that was received in the exchange. Failure to report n exchange and/or follow the rules can result in an investor being held liable for the capital gains tax amount as well as other penalties and interest.

Beware of Schemes

Investors should always be wary of anyone advertising a 1031 exchange as “tax-free” rather than a deferral of taxes, or those attempting to exchange ineligible properties such as primary residences or non-qualifying vacation homes. Investors are not allowed to claim a 1031 exchange if they have received the cash proceeds from a real estate sale into their bank accounts. Consult an accountant and/or tax professional to ensure that all rules and regulations are met.

Popular Markets for 1031 Exchanges

Because 1031 exchanges can be performed in all 50 states through this tax mechanism, you are able to swap your in-state properties for out-of-state properties. Based on trends, here is a top 10 list of popular real estate markets where 1031 exchanges are being explored the most as of 1/13/2022:

Have Questions? Get Help from the Pros

Is your head spinning with the possibilities of 1031 exchanges? Not to worry, our team of experts here at TFS Properties is here to help. Our seasoned personnel can assist you with the entire exchange so it’s a smooth and painless process for you as a real estate investor. Pick from our inventory of turnkey off-market rental property, strategically placed in stable US markets. Call us today or submit an introductory form to get started.

*Required