What is a Florida 1031 Exchange?

Florida 1031 exchanges work just like any other 1031 exchange in the country: as a tax deferral strategy for real estate investors. Also called a like-exchange or a Starker exchange, this strategy allows you as an investor to trade in one or multiple properties for different ones without incurring any federal capital gains taxes at the time, so long as the exchange is completed within a set time period.

2022 is an excellent year to consider making a 1031 exchange, since real estate prices have surged above the bubble prices of the last decade. In this article, we’ll provide a thorough guide to Florida 1031 exchanges: how they work, the rules that apply, and how to initiate an exchange. If you’re ready to dive in now or have specific questions, please give us a call at TFS Properties!

How Does a Florida 1031 Exchange Work?

Basically, a 1031 exchange allows a Florida real estate investor to defer the payment of federal capital gains taxes that would normally be incurred immediately upon the sale of a property when the profit from the sale is reinvested in a like-kind property of equal or greater value. ‘Like-kind’ means that the nature or character of the property must be similar, although it has no regard to the involved properties’ grade or quality.

Great Way to Leverage Your Cash

Beyond the obvious immediate benefit of deferring the payment of capital gains taxes, 1031 exchanges also allow investors to leverage their cash and increase their purchasing power, easily consolidate or diversify their portfolios, relocate their investments and reduce management costs and duties by switching from high-maintenance properties to lower-maintenance ones.

Great Way to Leverage Your Cash

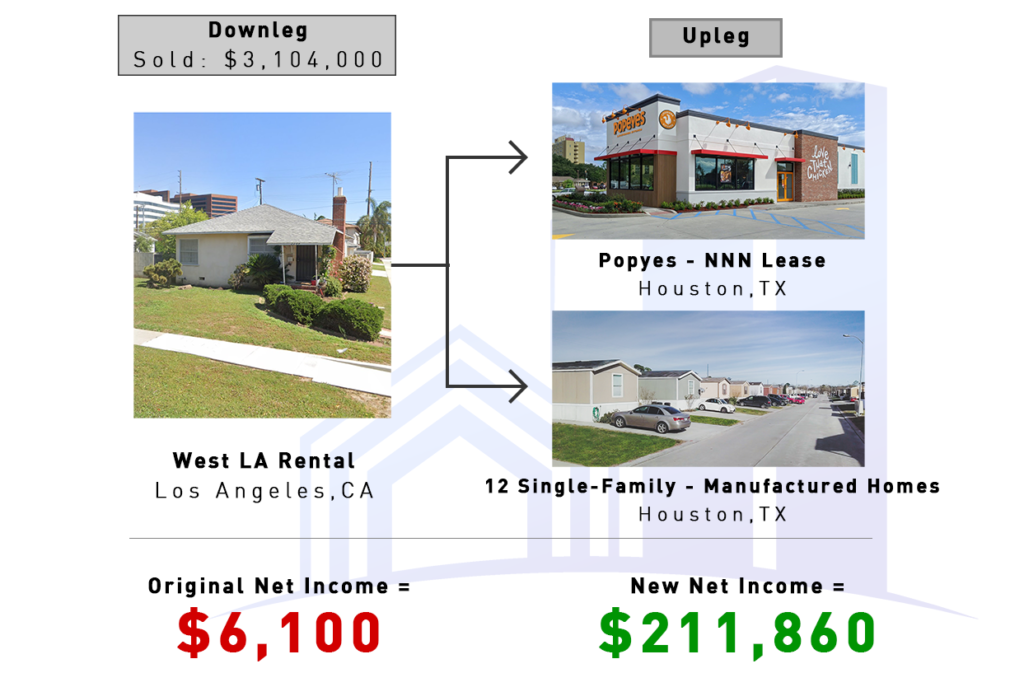

To perform a 1031 exchange, you will first identify the property that you wish to sell, called the relinquished property or the downleg. When that property is sold, the proceeds go directly into escrow under the management of a qualified intermediary. This keeps the funds out of your bank accounts and therefore exempt from immediate capital gains taxation

Once the sale of the downleg property is complete, you can identify the property or properties that you wish the purchase (called the upleg) with the proceeds of your downleg sale, and if the total value is greater than the value of your downleg and you complete the exchange within the set time limits, you can purchase the upleg property or properties without paying capital gains taxes on the sale of the downleg.

Don't Be Late

If the proceeds of the sale ever come into your bank account or are identified with your name, or if you don’t complete the exchange within the time limits, you will be taxed on the capital gains. This type of exchange is sometimes called a Starker exchange because of the 1979 Starker vs. United States court ruling, which determined that exchanging properties within a set time period is legally considered the same as a simultaneous property ownership transfer.

Florida 1031 Exchange Rules and Time Limits

There are several rules that apply to Florida 1031 exchanges:

Must Be "Like-Kind Property"

As we mentioned above, the properties exchanged must be like-kind, which means that they are similar in nature or character. The original premise of 1031 exchanges was that one property would be swapped directly for another, but this proved difficult to actually execute since the chance of finding someone who owns a property that you want and who wants to buy your relinquished property at the same time is slim.

Section 1031 used to be applicable for exchanges of a larger range of real estate types and personal property items, such as art, franchises, equipment, partnership interests, stock in trade, securities, certificates of trust, and beneficial interests. But, the scope of the program was limited starting January 1, 2018, to only include business or investment properties. No personal properties or primary residences may be exchanged using Section 1031.

Property types can include apartment buildings, duplexes, single-family rental properties, commercial office building rentals, vacation home rentals, and restaurant property rentals, among other things. All properties involved in the exchange must be located in the United States, although you can trade a Florida investment property for another property elsewhere in the country.

Multiple properties can be involved in the exchange. You can opt to relinquish one or more of your properties in exchange for one or more other properties. So, you could exchange three single-family home rental properties for one large apartment complex.

Must Be Great or Equal Value

To defer the capital gains tax on the entire amount of the proceeds from the sale of your property, you must invest the money into a property or properties of equal or greater value. You can, however, factor in inspection and broker fees to the total cost of the upleg properties.

Must Be the Same Taxpayer Name

In order to successfully complete a 1031 exchange, your name must appear the same on both the downleg sale papers and the upleg purchase papers. The only exception to this rule is if you use a single-member LLC to sell your property but purchase the new property under your individual name.

Don't Forget About "The Boot"

You can still execute a 1031 exchange if the replacement property or properties are worth less than the downleg, but you will have to pay capital gains tax on the difference, which is called the boot. So, if you sold a property that was worth $1 million and purchased two properties whose total value was $750,000, you would pay taxes on the boot of $250,000. Capital gains tax rates vary based on your income bracket: either 0%, 15%, or 20%.

Read More: What is “The Boot” and Napkin Test?

Timing Rules for 1031 Exchange

Once the sale of your property closes, you have 45 days to identify potential replacement properties. You have 180 total days from the date of sale of your property to complete the purchase of the upleg property or properties.

Qualified Intermediary

A qualified intermediary must be used to hold the proceeds of the sale of your property in escrow until they can be applied to the purchase of the upleg properties. Again, this is so the money is never actually deposited in your account which means you do not immediately get taxed. The QI will manage the money and ensure that all involved parties keep their ends of the deal.

Common 1031 Exchange in Florida

The most common type of 1031 exchange used in Florida and throughout the country is a delayed exchange. This is the type that we described above where you sell your property first and then later purchase another property, with the 45-day identification period and the 180-day completion period. However, there are three other less common types of 1031 exchanges that can be performed.

A reverse exchange is, predictably, the exact opposite of a delayed exchange. You would first purchase the replacement property and then later sell your relinquished property. This can be difficult to pull off, since you must use cash only for the purchase, and many banks will not provide loans for reverse exchanges. But, if you have enough cash accessible, it can be done.

A simultaneous exchange requires that the sales of both the relinquished and replacement properties close at exactly the same time. A slight delay, even if both still occur on the same day, can disqualify the exchange and result in you being taxed on the full amount of the sale of your property.

Finally, a construction or improvement exchange allows you to make improvements on the replacement property using the proceeds from the sale of your relinquished property, while your qualified intermediary holds the property deed in trust for up to 180 days. Additional requirements apply to this type of exchange.

Florida 1031 Exchange Property Types

We mentioned a few property types earlier that are eligible for 1031 exchanges in Florida, but this is a more comprehensive list:

- Vacant land (an improvement 1031 exchange can also be used to build on vacant land)

- Businesses

- Shopping malls and strip malls

- Golf courses and practice ranges

- Trailer or manufactured home parks

- Self-storage facilities

- Oil, gas, or mineral interests

- Water and ditch rights

- Parking lots

- Condos

- Medical and dental practices

- Convenience stores

- Vacation homes or condos

- Gas stations

- Apartments

- Hotels and motels

- Rental properties

- Conservation easements

- Communication towers

- Nursing homes

Vacation Rental Property Hold Time in Florida

In order to prevent the IRS from challenging whether a vacation rental property qualifies for a 1031 exchange, it must be rented out for at least 14 nights each year for a two-year period.

Your personal use of a vacation rental property must not exceed 14 nights per year or 10% of the number of days in a one-year period that the property is rented out. The time that you spend at the property to carry out repairs, annual maintenance, and so forth are not counted towards the 14-day limit.

Contact a Florida 1031 Exchange Company

If you need a 1031 expert in order to begin, contact us at TFS Properties! We have a network of real estate agents who can facilitate an exchange for you.