A 1031 Exchange Guide for California

A section §1031 exchange (sometimes also referred to as a Starker exchange or a like-kind exchange) is a tax deferral strategy used by many successful real estate investors. The State of California has a few additional rules that apply on top of the standard federal §1031 exchange rules and regulations. In this article, we’ll cover the basics of a California §1031 exchange, as well as the additional rules that specifically apply in the state of California.

Does California Recognize 1031 Exchange?

California recognizes 1031 Exchanges which allows an investor to defer capital gains taxes as long as you are purchasing another “like-kind” property to replace the one you are selling. California does recognize it if you purchase your upleg in another state, but beware of the above “Clawback” rule.

How Does a Californa §1031 Exchange Work?

In California, a §1031 exchange allows you, as a real estate investor, to defer the federal and state income tax that would normally be incurred from selling real property, by using the proceeds of the sale to immediately purchase another ‘like-kind’ property.

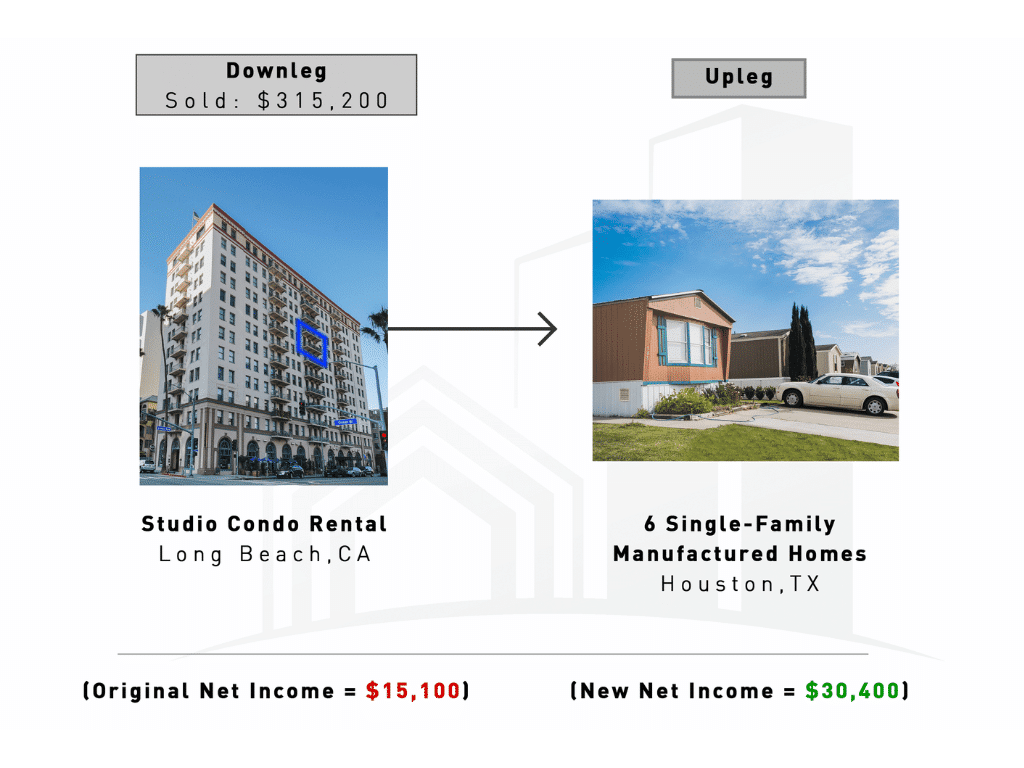

Image: A quick flowchart showing how a 1031 exchange works

Video: Using a 1031 Exchange to Diversify and Increase Cashflow

What is Like-Kind Property?

Like-kind property in a is a broad description of properties that are defined by the IRS as “the same nature or character, even if they differ in grade or quality.” In terms of a §1031 exchange, this means that any type of investment property can be exchanged for any other type of investment property, with the exception of any personal property (such as your primary residence or vacation home) which is not eligible for this type of trade.

This allows you to shift the focus of your investments, for example, transitioning from high-maintenance investments to low-maintenance investment properties or if you want to move your investments from one state to another, without income tax ramifications.

The primary concept of a traditional §1031 exchange is that one property is swapped for another and deferring federal or state income tax on gains that could potentially be due in the case of a non-exchange sale.

It’s generally unlikely to find a property that you want to buy (an out-of-state or California replacement property) that is owned by someone who wants the property that you have (the property you will relinquish). There are several subtypes of §1031 exchanges, including delayed or three-party exchanges. These types of exchanges give you some leeway as far as transferring your equity from one property to another using a §1031 exchange.

What is a Relinquished Property

The relinquished property is the one that you are selling or exchanging out of in the §1031 exchange. Also known as the “Downleg.”

What is a Replacement Property

The replacement property is the one that you are acquiring or exchanging into in the §1031 exchange. Also known as your “Upleg.” You can choose to have up to three properties as your upleg as long as their value is equal to or greater than the downleg value (including the debt).

If you choose more than three properties for your Upleg you can use the 200% rule which says you can choose as many properties as you want, more than one replacement property as part of your §1031 exchange, so long as their values add up to no more than 200% of the value of the relinquished property value.

Of course, this strategy is only for tax deferral purposes, which means that you will eventually have to pay the tax on the investment if/when you sell your replacement property without using an additional §1031 exchange. There is an industry phrase, “swap till you drop” which basically means to continue to do 1031 exchanges on any investment property sale, and eventually, the demise of the owner (or either spouse) will trigger a step-up in basis.

This means that the “basis” from which point the capital gains taxes are calculated gets raised or stepped up to the current appraised value of the property at the time of the owner’s death. The property could be sold at this point by the widower or heir with no capital gains tax.

California §1031 Exchange Rules

There are some specific rules for §1031 exchanges [infographic] that occur in the state of California.

Intermediaries Need to Be Bonded

First, any qualified intermediaries who facilitates an exchange for a fee must maintain a bond of $1 million or more, deposit $1 million in cash, securities, or irrevocable letters of credit, or deposit all exchange funds in a qualified escrow or trust account.

Must Maintain Errors & Omissions Policy

A reverse or forward exchange is when you acquire the replacement property first and then sell your relinquished property afterward. There are some particularities that make this type of exchange a bit trickier. For instance, you have to purchase your replacement property with your personal funds and/or bank loan prior to selling your downleg.

Then when you sell your downleg you can replace your personal funds with the funds from your downleg’s sale. For many people having the wherewithal to do this is often cost-prohibitive.

Then the replacement property must be acquired from the exchange accommodation titleholder and using the funds from the downleg sale and replacing the funds that you had originally used to purchase the property.

You must also decide which of your properties is going to be relinquished and which are “parked,” or not available for sale as part of the exchange. In fact, you have 45 days from the date of closing of the replacement property to identify which of your properties is going to be sold. Then you will have 180 days from the date of closing of the replacement property to close the sale of the relinquished property.

This puts a lot of pressure on finding a buyer for your downleg investment property and closing the sale all within 180 days. The Reverse Exchange may be often referred to but is very uncommon due to its complexities.

Filing Requirement in California

You must report a like-kind exchange in California (FTB 3840) if you do both of the following:

- Perform a like-exchange of real property within California for real property located outside the state, and

- Defer any gain or loss under IRC §1031.

You are required to file FTB 3840 every subsequent year:

- For as long as you defer the gain or loss.

- If you exchange the out-of-state property for another out-of-state property using another §1031 exchange.

- Until you report and pay tax to the state of California on your deferred gain or loss.

- Until you die.

- Until you donate the property to a non-profit organization.

- An obvious question is: what happens if you move out of CA? Do you still have those requirements or owe the tax if you sell it while being a resident of that other state?

Read More: FTB.CA.gov

California Clawback Law

The California Clawback Provision states that any capital gains accrued from California real estate will be subject to California state tax upon the ultimate sale of the real estate, even if the owner has since used a §1031 exchange to acquire a property outside of the state.

The 4 Most Common Types of 1031 Exchanges

As we mentioned above, there are several different types of §1031 exchanges. Let’s look at the differences between the four primary types.

Simultaneous Exchange

As the name suggests, a simultaneous exchange is when the sales of the relinquished property and the replacement property close simultaneously on the same day. These types of exchanges are infrequent and less popular than the other types of 1031 exchanges we’ll discuss below. There can be no delay in the exchange – even short delays caused by wiring the funds through an escrow company can disqualify the exchange. There are three ways for a simultaneous exchange to happen:

- A two-party trade, where deeds are simply swapped.

- A three-party exchange, where an accommodating party facilitates the

- exchange transaction.

- A simultaneous exchange through a qualified intermediary.

This type of exchange was how all earlier exchanges occurred but this has obvious shortfalls. Coordinating the sale and simultaneous closing is often tricky.

Reverse Exchange

A reverse or forward exchange is when you acquire the replacement property first and then sell your relinquished property afterward. There are some particularities that make this type of exchange a bit trickier. For instance, you have to purchase your replacement property with your personal funds and/or bank loan prior to selling your downleg.

Then when you sell your downleg you can replace your personal funds with the funds from your downleg’s sale. For many people having the wherewithal to do this is often cost-prohibitive.

Then the replacement property must be acquired from the exchange accommodation titleholder and using the funds from the downleg sale and replacing the funds that you had originally used to purchase the property.

You must also decide which of your properties is going to be relinquished and which are “parked,” or not available for sale as part of the exchange. In fact, you have 45 days from the date of closing of the replacement property to identify which of your properties is going to be sold. Then you will have 180 days from the date of closing of the replacement property to close the sale of the relinquished property.

This puts a lot of pressure on finding a buyer for your downleg investment property and closing the sale all within 180 days. The Reverse Exchange may be often referred to but is very uncommon due to its complexities.

Construction or Improvement Exchange

This type of exchange allows you to use the equity from the sale of your relinquished property to purchase and improve the replacement property while the qualified intermediary holds the deed.

There are three main requirements that must be met for this type of exchange to qualify as a valid §1031 exchange:

- The entire exchange equity must be used for purchasing and completing the construction within the 180th day of the exchange to avoid paying federal and state income tax.

- You must receive “substantially the same property” as what you identified on the 45th day as your replacement property.

- The replacement property must be worth equal or greater value when it’s deeded to you as it was when you identified it for the exchange. The improvements must already be in place before you can receive the deed from the qualified intermediary.

It is also important to note that any labor or material charges incurred as part of the construction process are not considered ‘like-kind’ with respect to real estate. To ensure that this type of §1031 exchange qualifies for tax-deferral, we recommend careful planning and contacting a tax professional to consult on the specifics.

It’s also important to know that you can’t do a Construction Exchange into a property you already own, it has to be into a newly purchased property and all funds must be spent by the end of the 180 days or any remaining funds will be considered boot.

Finding the Right 1031 Exchange Facilitators in California

At TFS Properties, we specialize in guiding clients through the §1031 exchange process as Real Estate brokers. We will work closely with your chosen accommodator to make sure you sell and purchase within the allotted time frame mandated by the IRS.

Our priority is to protect our clients’ investments by providing sound investment strategies and advice. We provide a premium investing experience and help our clients achieve maximum value and often greatly increased cash flow from rental income.

We’re Your Local California 1031 Exchange Specialst

We are based in San Marino, but deal with clients from all of California, and we would be honored to advise you through your next §1031 exchange. Contact us today to set up a meeting to discuss your financial goals and your §1031 exchange plans.

The information contained within this article is not intended to be construed as written legal advice. To the extent, you need assistance or guidance on any information contained within this article please consult your tax advisor.