2025 Texas 1031 Exchange Guide

There are many different provisions that must be met and rules that must be adhered to in order to successfully complete a §1031 exchange, and often the rules vary slightly state to state.

In this article, we’ll share some of the most important points to keep in mind if you wish to complete a §1031 exchange in San Antonio, Austin, Fort Worth, or in any other part across the state of Texas.

How Does a 1031 Exchange Work in Texas?

The basic premise of a Texas 1031 exchange is the same as it is throughout the country; if you have real property that is used in your trade or business, or that you are holding for investment purposes and you wish to sell it, you may be able to defer the federal and state income taxes that would normally be incurred by selling such a property.

To achieve this tax deferral, you would need to use a §1031 exchange, which essentially allows you to sell your property and use the proceeds to purchase a like-kind property within a set time period.

Read More

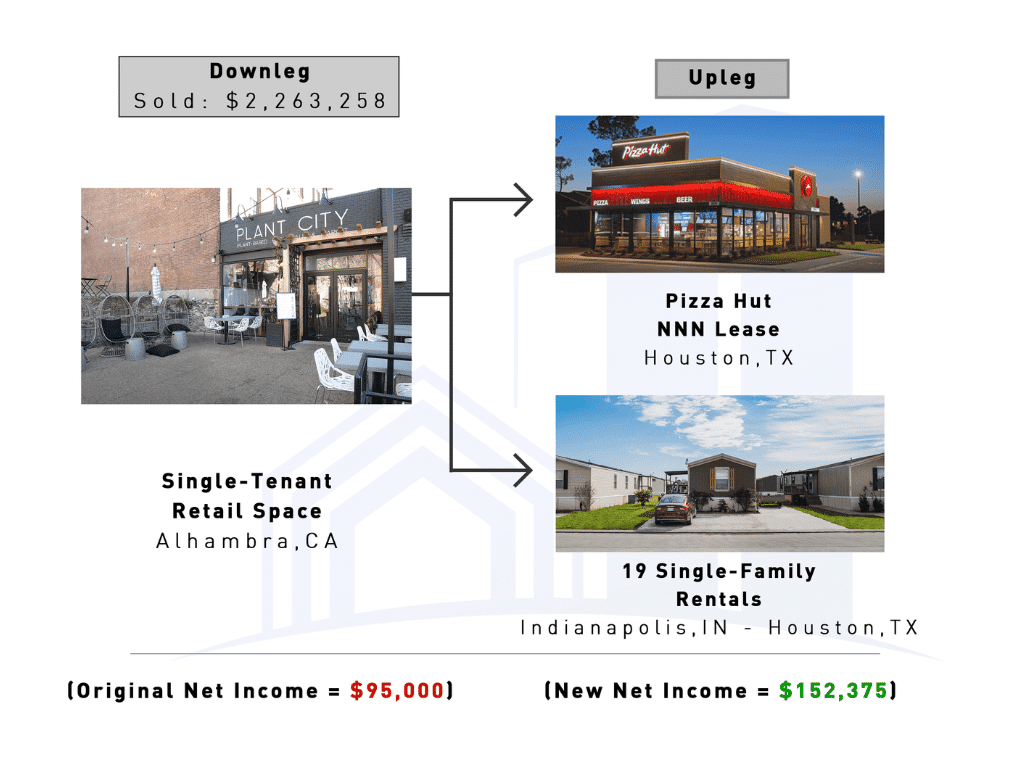

Image: A quick flowchart showing how a 1031 exchange works

Video: Using a 1031 Exchange to Diversify and Increase Cashflow

Texas 1031 Exchange Rules & Terms Explained

Now let’s dive into some definitions of terms and specific rules that apply for this type of tax-deferred exchange.

Relinquished Property

The relinquished property is the one that you are selling or exchanging in the §1031 exchange.

Replacement Property

The replacement property is the one that you are acquiring in the §1031 exchange. You can choose to have more than one replacement property as part of your §1031 exchange, so long as their values add up to no more than 200% of value of the relinquished property value. This is known as the ‘200% rule’ within the meaning of Treas. Reg. §1.1031.

It should also be noted that the replacement properties’ values will have no effect on the qualification of tax-deferred treatment under §1031 if no more than three like-kind properties are identified as replacement property. This is known as the “three property rule” which is discussed further below

The words “like-kind” refer to the nature or character of the property and not to its grade or quality. ‘Like-kind exchanges’ do not mean that the property that you are selling and the property you are buying must be specifically for the same use, such as an apartment property for another apartment property or undeveloped land for another parcel of undeveloped land.

Read More: What is Like-Kind Property?

Rather, it just broadly means that you must exchange real estate for real estate and that both properties involved must be either investment properties or those used in your trade or business property. §1031(a)(2) provides that “property held primarily for sale” is not eligible property for purposes of §1031, as either relinquished property (discussed below) or replacement property (also discussed below), even if it is used in a trade or business.

You could exchange a raw piece of land for a rental property within the rules of a §1031 exchange. However, properties that are for your personal use (your primary residence, vacation homes, etc.) are not eligible for §1031 exchanges. In addition, due to the December 2017 Tax Cuts and Jobs Act, any §1031 exchange property is limited to like-kind “real property” that is held for productive use in a trade or business.

Exchange Proceeds

The proceeds from selling your relinquished property will be received by a qualified intermediary on your behalf in order to avoid constructive receipt issues. When you have selected your replacement property, the cash will be directed to that seller. So long as all of the proceeds of the sale are used to purchase the replacement property, you will not pay any tax on the amount.

If the replacement property costs less than what you sold your relinquished property for, you will have to pay tax on the difference, also called “boot”. +Boot” can also include furniture, livestock, equipment, and other types of personal property that are transferred in connection with the relinquished property or the replacement property. Any personal property received in connection with the replacement property could be considered ‘boot’ and subject to federal income tax.

You must identify a replacement property (or multiple properties) that you are interested in buying via a written notice to your qualified intermediary within 45 days of closing the sale of your relinquished property. The closing date does not count as part of the 45-day period, and the true end of this designation or identification period may fall on a weekend or holiday.

If that’s the case, it would be wise to submit your written notice at least a couple of business days before the true end date, or ideally sooner if you have a replacement property in mind.

The 180-Day Rule

You must close, fund, and acquire the replacement property or properties within 180 days of closing the sale on your relinquished property. As with the 45-day rule, the date of closing does not count in the 180-day period and the true end of the period may fall on a weekend or holiday.

It’s important to note that both the 45-day identification period and the 180-day closing period start the day after the date of sale of the relinquished property – they do not happen one after the other. If you do not meet either of these deadlines, your exchange may be disqualified under §1031

There is an exception to the 180-day rule: you may be required to complete the exchange sooner if you have to file your federal income tax return for the year that the sale of your relinquished occurred before 180 days have lapsed.

If you close the sale of the relinquished property on December 1, ordinarily you would have nearly 6 months to complete the exchange, but since federal income tax returns are due on March 15 or April 15, you would only have 3.5 to 4.5 months to complete it depending on the tax classification of the entity completing the §1031 exchange.

If this happens to occur in your situation, we recommend filing for an extension of time to file your federal and state income tax (if applicable) returns to receive the full 180 days.

The Three Property Rule

If you designate more than three properties as potential replacement properties, the aggregate amount of all the properties’ fair market values must not exceed more than two times the gross sales price of the relinquished property. It should be noted that the three property rule will not apply if the three or less properties are identified as replacement properties.

Direct Deeding

Previously, the deeding process for a 1031 exchange was cumbersome: you as the seller would deed the relinquished property to your qualified intermediary who would then deed it to the buyer of that property, and the seller of the replacement property would deed it to the intermediary who would then deed it to you.

Now, the process is more streamlined so you can deed the relinquished property directly to the buyer and the seller of the replacement property can deed it directly to you.

Intermediary Rule

You cannot have access to the money acquired dring the 180-day period of a Texas 1031 Exchange. You will need to hire a qualified intermediary who is not related to you in any way to hold the funds in a specific account until directed to purchase the replacement property.

Title Rule

To ensure that no shady business is going on, the Title Rule requires that your name must exactly match both on the relinquished property and the replacement property.

Greater or Equal Value Rule

It is allowed to select more than one replacement property. However, their total combined cost must not exceed more than 200% of your relinquished property cost.

Types of 1031 Exchanges in Texas

On this page, we won’t go into detail because each state has the same 4 main types of exchanges. To get a more in-depth read we recommend reading our 1031 Exchange for Real Estate Investors. The four types are:

Simultaneous Exchages

A simultaneous §1031 exchange occurs when the sales of the relinquished property and the replacement property close at the exact same time.

Delayed Exchanges

The most popular is the Delayed §1031 exchanges. They allow you to sell your relinquished property at a later date within a certain period of time and then identify and purchase the replacement property.

Reverse Exchanges

Opposite to delayed exchanges, a reverse exchange allows you to purchase the replacement property first and then sell your relinquished property at a later date.

Construction or Improvement Exchanges

In a Construction or Improvement type of exchange, you are allowed to use the equity from the sale of your relinquished property to make improvements on the replacement property. A qualified intermediary must hold onto the need. It’s also important to remember that the ‘Napkin Test’ may apply to improvement §1031 exchanges.

7 Steps To Take in a Texas §1031 Exchange

Now that we’ve covered the main rules and definitions of a 1031 exchange in Texas, let’s break down the process into the concrete steps that you need to take:

- Select a qualified intermediary to help you navigate the §1031 exchange process and hold the sale proceeds on your behalf.

- Complete the necessary documentation before you close the sale of your relinquished property.

- Arrange for the sale of your relinquished property. The proceeds will be sent to your qualified intermediary.

- Identify a replacement property or properties within 45 days of the closing of the sale of your relinquished property and provide a written notice to your qualified intermediary.

- Enter into a contract to purchase the replacement property.

- Complete the purchase of the replacement property within 180 days of the closing of the sale of your relinquished property.

- Enjoy the deferment of your federal and state income taxes!

Video: Using a 1031 Exchange to Diversify and Incease Cashflow

Finding the Right Texas 1031 Exchange Company

At TFS Properties, we have specialized in 1031 exchange planning and execution for more than 30 years. Our top priority is protecting our investors’ portfolios by providing them with sound investment strategies and expert advice. We offer first-rate investment experiences for our clients while helping them achieve the maximum possible value.

The information contained within this article is not intended to be construed as written legal advice. To the extent, you need assistance or guidance on any information contained within this article please consult your tax advisor.